Silver stands as one of the most misunderstood and emotionally traded assets in financial markets. Unlike straightforward commodities or purely speculative assets, silver occupies a unique position that demands careful analysis and disciplined execution.

Most traders make a critical error from the start: treating silver as simply a cheaper version of gold. This fundamental misunderstanding alone causes numerous costly trading mistakes.

Silver doesn’t behave like gold. It certainly doesn’t behave like cryptocurrency. To trade silver successfully, you must understand the specific factors that actually drive its price movements.

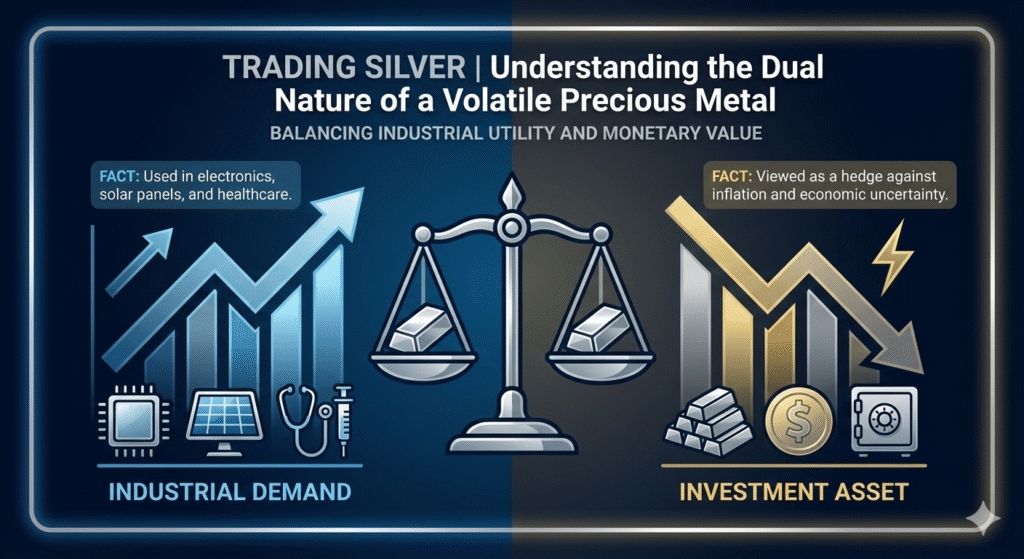

The Dual Nature That Changes Everything

Silver functions as both a precious metal and an industrial metal. This single characteristic fundamentally changes how it trades and responds to market conditions.

Gold moves primarily on fear, safety concerns, and monetary confidence. Its role as a pure store of value means it reacts to financial stress and currency instability.

Silver moves on economic conditions, industrial demand, global liquidity, and speculation. It responds to manufacturing activity, technology adoption, and growth expectations while also maintaining its monetary characteristics.

This dual nature explains why silver exhibits significantly higher volatility than gold, why it reacts faster to changing conditions, and why it consistently punishes emotional or unprepared traders.

Multiple Demand Sources Create Complex Price Dynamics

Silver demand originates from several distinct sectors, each responding to different economic drivers.

Industrial applications consume the majority of silver supply. It’s extensively used in electronics manufacturing, solar panel production, medical technology, automotive systems, and various manufacturing processes. These industrial uses create demand that correlates with economic growth and technological advancement.

Simultaneously, silver functions as a store of value and investment asset. Investors accumulate physical silver during periods of monetary uncertainty, similar to gold but typically with different timing and intensity.

This dual role makes silver uniquely sensitive to both economic expansion and economic stress, creating price behavior that can seem contradictory or confusing to those unfamiliar with these dynamics.

Paper Markets Dominate Price Discovery

A critical factor that many silver traders overlook: most silver trading doesn’t involve physical metal at all.

Paper trading through futures contracts, exchange-traded products, and institutional positioning plays the dominant role in short-term price formation. The silver market is heavily financialized, meaning prices respond more to expectations, positioning, and speculation than to physical supply-demand imbalances.

This is where countless traders fail. They focus exclusively on price charts while ignoring the broader environment in which silver trades. Understanding market structure and positioning becomes as important as technical analysis.

Key Macro Factors Driving Silver Prices

Silver reacts strongly to several macroeconomic variables that traders must monitor consistently.

Interest Rates: When interest rates rise, holding non-yielding assets like silver becomes less attractive from an opportunity cost perspective. Higher rates can create sustained pressure on silver prices. Conversely, when rates stabilize or decline, silver becomes more appealing to investors seeking alternatives.

This relationship isn’t instantaneous, but it remains consistent over time. Professional silver traders always factor interest rate expectations into their analysis.

US Dollar Strength: Silver is priced in US dollars globally. When the dollar strengthens against other currencies, silver typically faces headwinds. When the dollar weakens, silver often finds support and can rally.

This correlation isn’t perfect or constant, but it matters significantly. Professional traders continuously monitor dollar behavior and its relationship to silver price action.

Global Liquidity Cycles: When global liquidity expands through monetary policy, speculative assets including silver often benefit substantially. Silver reacts particularly strongly during these expansionary phases.

When liquidity conditions tighten, volatility increases dramatically and silver becomes unforgiving to overleveraged or poorly positioned traders.

Volatility Creates Opportunity and Danger

Silver is notorious for sharp, aggressive price movements in both directions. It rallies quickly when conditions align, and it corrects even faster when sentiment shifts or technical levels break.

This volatility creates genuine trading opportunities but also substantial danger for unprepared participants.

Many traders are initially attracted to silver specifically because it “moves more” than gold or other precious metals. But movement without proper risk management and emotional control leads directly to losses.

Silver trading demands exceptional discipline precisely because of its volatility characteristics.

Common Mistakes That Destroy Trading Accounts

Over-Leveraging Positions: Because silver is volatile, even modest price moves can trigger large emotional reactions and margin calls. Leverage magnifies both gains and costly mistakes.

Professional traders typically reduce position sizes when volatility increases. Retail traders often do the opposite, increasing exposure exactly when risk is elevated.

Treating Silver as a Guessing Game: Silver rewards structured approaches based on macro alignment, key technical zones, and market sentiment analysis. It punishes random entries based on hope or predictions without supporting analysis.

Ignoring Market Positioning: Silver reacts strongly to extreme positioning. When too many traders crowd onto one side of the market, silver frequently moves against them, stopping out the majority before resuming the expected direction.

This is why understanding sentiment and positioning matters as much as technical analysis. Extreme optimism creates vulnerability. Extreme pessimism often creates opportunity.

The Importance of Patience and Timing

Silver doesn’t move in clean, predictable straight lines. It consolidates extensively, creates false breakouts that trap traders, and requires patience to wait for genuine opportunities.

Impatient traders get repeatedly chopped by these characteristics. Patient traders wait for proper confirmation before committing capital.

Silver trading isn’t about capturing every minor move. It’s fundamentally about capital preservation. Once your trading capital is gone, market opportunities become irrelevant.

Survival comes first. Profit opportunities come later, after you’ve proven you can manage risk effectively.

Long-Term Demand vs. Short-Term Volatility

Structural demand for silver continues growing due to green energy adoption, electrification trends, and expanding technology applications. These long-term demand drivers are real and significant.

However, long-term demand doesn’t eliminate short-term volatility or guarantee continuous price appreciation. This is where many investors confuse compelling narratives with actual trading timing.

Silver reflects economic reality faster than many other assets. It reacts to changes in manufacturing expectations, growth outlooks, and economic stress. But it doesn’t explain these reactions clearly in real-time. Traders must read and interpret context.

Professional Trading Requires Flexibility

Silver punishes emotional attachment to specific price directions or biases. If you become convinced silver “must” move in a particular direction and refuse to adapt when conditions change, the market will humble you.

Professional silver traders maintain flexibility. They adapt their approach to changing conditions and respect uncertainty as inherent to the trading process.

Silver trading isn’t about being right on every position. It’s about effectively managing risk when you’re wrong. Losses are inevitable and represent part of the normal trading process. Long-term survival depends entirely on how you handle those losses.

Historical Patterns and Cycle Recognition

If you study silver’s historical behavior across multiple market cycles, one pattern becomes unmistakably clear: silver rewards those who understand and respect cycles while removing those who chase excitement or short-term momentum.

Different years bring different conditions and different narratives. But the underlying behavioral patterns remain remarkably consistent.

Silver Is Not Beginner-Friendly

Silver trading demands genuine patience, consistent discipline, and deep respect for market forces. It’s not an appropriate market for beginners seeking quick profits or testing strategies.

Those who rush into silver without proper preparation get punished through losses. Those who invest time in preparation and learning before committing significant capital improve their survival odds substantially.

Trading silver successfully isn’t about ego or being smarter than other market participants. It’s about consistency—making sound decisions repeatedly over extended periods rather than seeking one dramatic winning trade.

Approaching Silver Trading Professionally

If you want to trade silver at a professional level, you must stop treating it as a shortcut to quick profits. Silver is a serious market with sophisticated participants, and it demands serious, structured behavior.

Silver doesn’t forgive emotional trading, impulsive decisions, or poor risk management. But it does reward structured thinking, proper preparation, and disciplined execution.

Understanding silver’s dual nature as both industrial and precious metal, respecting its volatility characteristics, monitoring relevant macro factors, and maintaining emotional discipline separate consistently successful traders from the majority who struggle.

The silver market will continue presenting opportunities. Whether you can capitalize on those opportunities depends entirely on your preparation, discipline, and willingness to trade based on structure rather than emotion or prediction.

Task Verify Code: Nature