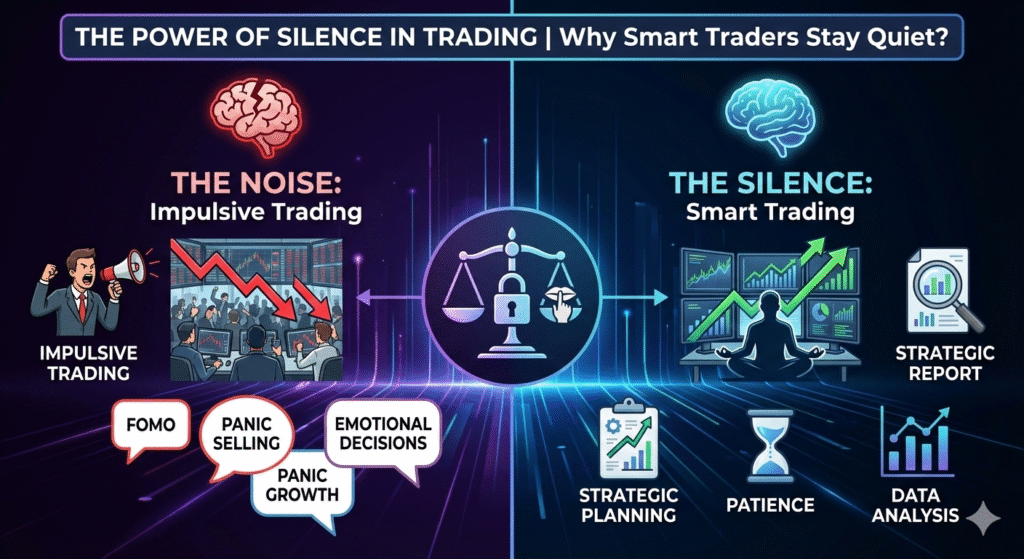

There’s a characteristic that clearly separates disciplined traders from emotional ones, yet it remains completely misunderstood by most market participants: strategic silence.

Smart traders are rarely loud. They don’t constantly share opinions, react to every price candle, or strive to maintain visible presence in trading communities. This intentional silence isn’t confusion or fear—it’s disciplined restraint that directly contributes to long-term profitability.

Understanding why successful traders embrace silence reveals fundamental truths about sustainable trading approaches.

The Illusion of Constant Action

The biggest mistake most traders make is believing success comes from constant activity. They operate under several false assumptions:

More trades equal more opportunities. More expressed opinions demonstrate more knowledge. More visible activity means more control over outcomes.

The market doesn’t reward this approach.

Markets reward precise timing over sheer effort. They reward patience over constant activity. And they consistently punish traders who feel compelled to always be involved in active positions.

This fundamental misunderstanding destroys more trading accounts than almost any other factor.

Most Market Movement Isn’t Tradeable

Smart traders understand a critical distinction: price moves constantly, but genuine high-probability opportunities are rare.

Most market movement reflects random noise, emotional overreactions, or short-term positioning that reverses quickly. Trading every visible price move isn’t strategy—it’s impulse-driven behavior that accumulates transaction costs and emotional exhaustion.

Strategic silence allows disciplined traders to wait patiently for proper alignment of multiple factors: clear market structure, technical confirmation, favorable risk-reward ratios, and macro conditions that support their directional bias.

If these conditions aren’t clearly present, sophisticated traders make a conscious decision: they do nothing. And doing nothing frequently represents the most profitable decision available.

Protecting Mental Capital Through Selective Engagement

There’s a crucial psychological dimension to trading silence that most participants completely overlook.

Every trade executed drains mental energy. Every decision point increases emotional exposure and psychological burden. Over extended periods, excessive decision-making steadily weakens discipline and judgment quality.

Smart traders protect their mental capital as carefully as their financial capital. They understand that cognitive resources are limited and must be allocated strategically.

By maintaining silence and avoiding unnecessary trades, they accomplish several important goals: preventing decision fatigue that degrades judgment quality, avoiding emotional attachment to positions that clouds rational thinking, and eliminating the compulsion to force trades simply to feel productive or engaged.

Mental preservation enables better decisions when genuine opportunities actually appear.

Ego Control and Opinion Detachment

Another critical reason experienced traders maintain strategic silence relates to ego management.

When traders frequently vocalize their market views and predictions, they become psychologically attached to being proven correct. Their identity becomes intertwined with their expressed opinions.

This attachment creates serious problems. Traders start defending positions instead of objectively managing risk. They hesitate to exit losing trades because admitting the loss feels like admitting personal failure. They hold positions too long hoping the market will eventually validate their prediction.

Smart traders deliberately remove ego from their trading process. They don’t seek validation from others. They don’t need to be publicly correct. They allow the market to determine outcomes privately without the added pressure of public accountability.

This detachment enables faster, cleaner exits when positions move against them—a skill that separates long-term survivors from those who eventually blow up their accounts.

Silence Creates Mental Clarity

Without constant noise—both from external sources and self-generated commentary—emotional intensity naturally decreases.

Biases fade when not repeatedly reinforced through vocalization. Execution becomes cleaner and more objective. Decision-making improves when not clouded by the need to maintain consistency with previously stated views.

In a financial world where everyone chases attention, reacts instantly to headlines, and posts real-time predictions, strategic silence becomes a genuine competitive advantage.

Silence keeps traders genuinely focused on relevant information. It maintains patience during extended periods without clear opportunities. And most importantly, it keeps traders psychologically stable enough to survive through inevitable losing periods.

The Long-Term Survival Advantage

Smart traders aren’t attempting to impress anyone. They’re not competing for social media engagement or trying to build a reputation as a market guru.

They’re simply trying to last—to survive long enough that their edge can compound over many years of trading.

The traders who constantly broadcast their views, share every trade, and maintain high visibility often experience shorter careers. The psychological pressure of public trading, the ego attachment to being right, and the constant decision-making all work against long-term survival.

Meanwhile, quiet traders who execute selectively, manage risk carefully, and avoid the psychological burden of public performance tend to last longer and compound gains more consistently.

Trading vs. Not Trading

One of the most important lessons in trading psychology is understanding that not trading represents a legitimate strategic position.

Many traders struggle with this concept. They feel unproductive when not actively in positions. They fear missing opportunities during periods of inactivity. They mistake action for progress.

But experienced traders recognize that capital preservation during unclear periods creates the foundation for profits during clear periods. Sitting in cash while waiting for proper setups isn’t passive—it’s active risk management.

The best traders often have relatively low trading frequency. They execute when conditions genuinely favor their approach, and they observe without participating the rest of the time.

This selective engagement is only possible through embracing strategic silence rather than constantly reacting to market noise.

Silence as Information Filter

The modern trading environment bombards participants with constant information: news feeds, social media predictions, technical alerts, economic data releases, and endless market commentary.

Most of this information is noise that doesn’t impact actual trading decisions.

Strategic silence helps traders filter signal from noise. By not feeling compelled to have opinions on everything or react to everything, they can focus exclusively on the specific information that genuinely matters for their particular strategy.

This filtering capability becomes increasingly valuable as information overload intensifies across financial markets.

The Discipline of Waiting

Perhaps the most underappreciated aspect of trading silence is that it represents the discipline of waiting.

Waiting without acting requires genuine discipline. It feels unnatural. It contradicts the action-oriented instinct that initially attracts many people to trading.

But waiting is where edges are preserved. Waiting is when poor traders eliminate themselves through overtrading. Waiting is when psychological discipline either strengthens or breaks down.

Smart traders have mastered the art of patient waiting. They can sit through weeks of choppy, unclear conditions without feeling compelled to participate. When clarity finally emerges, they’re mentally fresh and financially preserved to act decisively.

Respecting Your Own Silence

If you want genuine long-term survival in trading, developing comfort with silence becomes essential.

Learn to value patience as actively as execution. Understand that not trading is often the smartest trade available. Recognize that protecting your mental and financial capital during unclear periods enables you to capitalize fully when clear opportunities eventually appear.

The market will always be there tomorrow. The constant price movement creates an illusion of urgency that doesn’t actually exist. Real opportunities are worth waiting for, and they only appear clearly to those who haven’t exhausted themselves chasing every minor fluctuation.

Strategic silence isn’t weakness or indecision. It’s a deliberate competitive advantage that enables better timing, clearer thinking, and ultimately, sustainable profitability over careers measured in years rather than months.

Task Verify Code: Comfort