Overtrading represents one of the most dangerous habits in trading—a silent destroyer that quietly erodes accounts without dramatic crashes or obvious warning signs.

What makes overtrading particularly insidious is that it’s rarely obvious to the trader engaged in it. It doesn’t initially look like recklessness or poor discipline. In fact, overtrading often disguises itself as dedication, hard work, and active market engagement.

But overtrading is none of those positive qualities. It’s a slow, persistent leak in your account and a continuous drain on your psychological capital that eventually leads to failure.

Understanding how and why overtrading destroys trading careers is essential for long-term survival.

The Real Cause of Most Trading Failures

Most traders don’t ultimately fail because their market analysis is fundamentally flawed. They fail because they execute too many trades.

They feel compelled to always be involved in active positions, constantly engaged, always doing something visible. The market psychologically conditions participants to believe that opportunity is constant and unlimited.

Price movement never stops, so traders naturally assume money-making opportunities never stop either. This assumption represents one of the most destructive lies in trading.

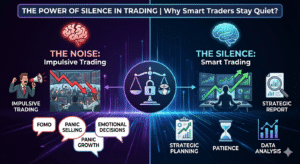

Movement is not opportunity. Activity is not progress. Constant execution is not professional trading—it’s a behavioral compulsion that guarantees eventual failure.

How Overtrading Begins: The Impatience Cycle

Overtrading typically starts subtly with impatience. A trader enters a position without complete confirmation because waiting feels unproductive. Then another trade quickly follows, often attempting to “fix” or offset the first position.

Within a short period, trading transforms from a planned, strategic process into a reactive loop driven by emotions rather than analysis.

This transition marks where real damage begins accumulating.

Every additional trade increases exposure to risk—not just financial risk from market movements, but psychological risk from emotional investment in outcomes. Trader confidence gradually becomes dependent on short-term results instead of long-term process execution.

As trades stack up without proper selection criteria, discipline steadily weakens. Risk management rules that were initially strict become flexible and situation-dependent. Clear guidelines transform into loose suggestions that can be bent when convenient.

Small, manageable losses begin compounding into significant drawdowns that threaten account survival.

The Clarity Problem

Overtrading systematically destroys mental clarity and decision-making quality.

When too many positions are simultaneously open or when trades are executed in rapid succession, decision-making becomes rushed and reactive. Traders stop patiently waiting for high-quality setups that meet all their criteria and start accepting mediocre setups that meet only some requirements.

The quality standard drops significantly, but the risk exposure per trade remains the same or even increases.

This dynamic explains how accounts bleed slowly over time instead of collapsing in one dramatic failure. The death is gradual, making it harder to recognize and correct before substantial damage occurs.

Psychological Exhaustion: The Hidden Cost

Another critical reason overtrading proves so destructive is the psychological exhaustion it creates.

Successful trading demands sustained focus, disciplined patience, and consistent emotional control. Overtrading systematically drains all three of these essential psychological resources.

Decision fatigue inevitably sets in when traders make too many consecutive decisions. Mental energy depletes. Judgment quality deteriorates. Emotions gradually begin driving execution decisions instead of rational analysis.

The psychological experience also shifts dramatically. Losses feel disproportionately heavy and personally painful. Wins feel smaller and less satisfying, failing to provide the emotional reward they once did.

Eventually, traders reach a state where they’re no longer objectively trading market conditions. They’re trading their emotional states—chasing relief from anxiety, seeking validation after losses, or trying to recapture the feeling of previous wins.

The False Belief About Missing Opportunities

Many traders genuinely believe that trading less frequently means missing valuable opportunities. This fear of missing out drives continued overtrading despite mounting losses.

Experienced traders understand the opposite is actually true.

Trading less means actively protecting capital during unclear conditions. Trading less means maintaining selectivity and only engaging with genuinely high-probability setups. Trading less means strategically waiting for the specific market conditions where your particular edge actually functions.

Professional traders recognize that their trading edge only works reliably in specific market environments and setup types. Outside those particular conditions, their approach has no statistical advantage.

Rather than forcing trades during unfavorable conditions just to feel productive or engaged, they consciously choose to stay out and preserve capital.

The Ego Component

Overtrading frequently has roots in ego-driven needs rather than rational strategy.

The psychological need to prove skill and competence. The fear of missing market moves that others might profit from. The profound discomfort of sitting idle while markets move actively.

But doing nothing when conditions don’t favor your approach is not failure or weakness. Doing nothing in those circumstances is genuine discipline.

Markets will always be available tomorrow. Your trading capital might not survive if you continue forcing trades today during unfavorable conditions.

Understanding this distinction separates traders who last for years from those who wash out within months.

Activity vs. Consistency

The fundamental goal of trading is not maximizing activity or number of trades executed. The goal is achieving consistency in results over extended periods.

Consistency comes from disciplined restraint and selective engagement, not from repetitive execution regardless of conditions.

High trading frequency might create the feeling of professional engagement, but frequency alone doesn’t correlate with profitability. In fact, for most retail traders, higher trading frequency correlates negatively with returns after accounting for transaction costs and psychological factors.

The most consistently profitable traders are often the least busy in terms of trade count. They execute infrequently but with precision when conditions genuinely align with their approach.

Learning When Not to Trade

If you want genuine long-term survival in trading, developing the skill of knowing when not to trade becomes as important as knowing when to enter positions.

You must cultivate the ability to sit comfortably through extended periods of boredom while waiting for proper setups. You must accept that professional traders are often inactive for days or weeks at a time.

This acceptance requires overcoming deeply ingrained psychological biases toward action and productivity. Modern culture conditions people to equate busyness with value and success, but this equation doesn’t apply to trading.

In trading, strategic inactivity during unfavorable periods creates the foundation for profitable activity during favorable periods.

The Slow Destruction Pattern

Overtrading doesn’t destroy accounts in one catastrophic day or dramatic blowup. It destroys them slowly, quietly, and consistently over weeks and months.

A series of small losses from mediocre setups. Gradually increasing position sizes in an attempt to recover. Slowly degrading risk management standards. Mounting psychological pressure from consecutive losing trades.

By the time traders recognize the pattern, substantial damage has already occurred. Account equity has declined significantly. Psychological confidence has eroded. The path back to consistent profitability has become much steeper.

Practical Solutions to Overtrading

Recognizing overtrading tendencies is the first step. Implementing structural solutions is the second.

Set Maximum Trade Limits: Establish hard limits on maximum trades per day or week, regardless of perceived opportunities. This creates forced discipline when psychological discipline weakens.

Define Your Edge Clearly: Write explicit criteria for what constitutes a valid setup for your strategy. If a potential trade doesn’t meet all criteria, don’t take it regardless of how compelling it looks.

Track Trade Quality, Not Just Results: Review whether each executed trade met your predefined criteria, separate from whether it was profitable. This focuses attention on process rather than outcomes.

Embrace Boredom as Professional: Reframe periods of inactivity as professional discipline rather than missed opportunity. The best traders spend most of their time waiting, not executing.

Monitor Psychological State: Recognize when decision fatigue, frustration, or excitement is driving the urge to trade. These emotional states reliably produce poor trading decisions.

The Long-Term Perspective

Avoiding overtrading gives you a genuine chance to last long enough for your edge to compound over time.

Trading careers aren’t built on constant activity. They’re built on capital preservation during unclear periods and selective aggression during clear periods.

The psychological challenge is that this approach feels passive and unproductive compared to constant engagement. But feelings don’t determine profitability—results do.

Traders who master restraint, who can sit comfortably in cash for extended periods, who execute only when conditions genuinely favor their approach—these are the traders who survive long enough to eventually thrive.

Overtrading will always be tempting. The urge to act, to be involved, to not miss anything remains a constant psychological pressure. But giving in to that pressure guarantees eventual failure.

Resisting that pressure, maintaining discipline during boredom, and protecting capital during unfavorable conditions separates sustainable trading careers from brief, unsuccessful attempts at market participation.

Task Verify Code: Overtrade