When you step back and carefully observe the cryptocurrency market today, a striking pattern emerges: nothing is fundamentally new.

The technology appears different. The platforms look modern. The coin names constantly change. But the outcome remains remarkably consistent.

People were losing money in crypto years ago. They’re losing money today. And most participants will continue losing money in the future—not because cryptocurrency is inherently a scam, but because human behavior never changes.

Understanding why this pattern persists is essential for anyone involved in cryptocurrency markets.

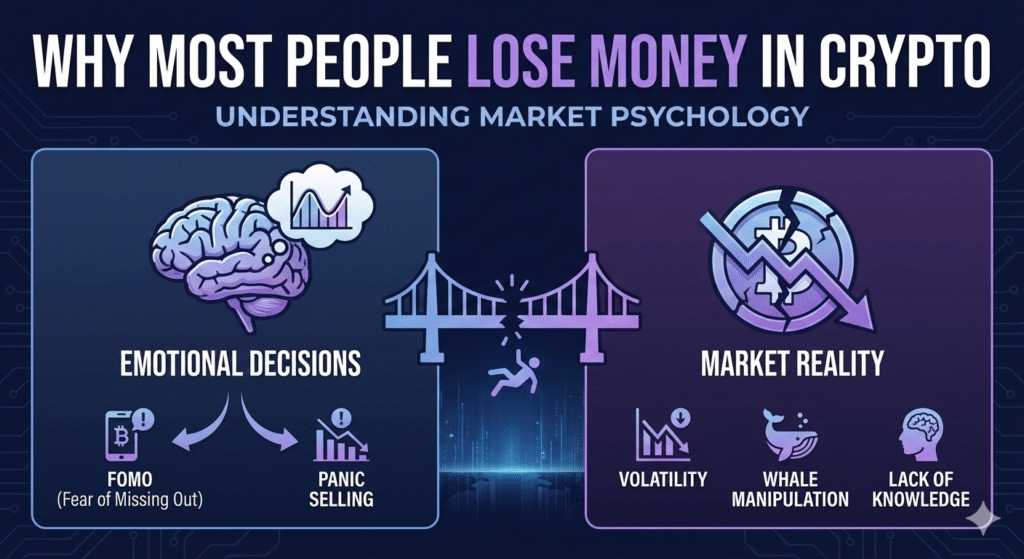

Markets Are Structured Around Psychology, Not Chaos

Cryptocurrency markets aren’t random or chaotic. They’re highly structured around predictable psychological patterns.

Every time prices move upward, confidence gradually transforms into greed. Every time prices decline, fear replaces rational decision-making. This emotional cycle isn’t unique to crypto—it has existed in stock markets, commodity trading, and real estate speculation for centuries.

Cryptocurrency simply exposes these psychological patterns faster and more visibly than traditional markets.

The Illusion of Easy Money

Most people enter cryptocurrency markets without understanding what they’re actually entering. They don’t come to study complex systems or learn proper risk management principles. They enter because they’ve witnessed others apparently making money.

Social media feeds fill with screenshots of profitable trades, success stories, and displays of wealth. What remains invisible are the countless losses behind those carefully curated narratives.

New participants assume opportunity automatically means certainty. This assumption—that visible success translates to guaranteed outcomes—represents one of the most dangerous illusions in financial markets.

Why Intelligence Doesn’t Guarantee Success

Cryptocurrency markets don’t primarily reward intelligence or technical knowledge. They reward discipline and emotional control.

This explains why even highly intelligent people frequently lose money in crypto. They overreact to price movements, overtrade their positions, and confuse constant activity with actual progress.

Buying and selling creates the feeling of productive action. But action without strategic direction becomes extremely expensive over time.

The Dangerous Pattern of Market Cycles

Market history reveals one pattern that never disappears, regardless of the asset class.

Early phases remain quiet with minimal public interest and no widespread excitement. Then prices begin moving gradually, confidence builds, and compelling narratives emerge to explain the movement.

Suddenly, everyone claims to understand cryptocurrency. Suddenly, everyone becomes a self-proclaimed expert sharing predictions and analysis.

That inflection point—when cryptocurrency dominates conversations and confidence peaks—typically represents the moment when risk is actually highest.

Buying Confirmation Instead of Value

Most market participants don’t buy value. They buy confirmation and consensus.

They wait until widespread agreement validates their decision. By that point, the market has typically already moved significantly, leaving them entering at elevated prices.

This behavioral pattern explains why most people buy late in rallies and sell early in downturns. Not because they’re unlucky or lack information, but because they prioritize psychological comfort over logical analysis.

The Cost of Impatience

Another fundamental reason people lose money is impatience. They want immediate results and expect markets to move according to their personal timelines and financial needs.

Markets don’t care about individual schedules or expectations.

Impatience creates forced decision-making. Forced decisions lead to costly mistakes. Sometimes the most professional move is making no move at all—simply waiting.

But doing nothing feels uncomfortable. And discomfort is something most people actively avoid, even when avoidance carries a price.

Volatility Isn’t the Problem

Cryptocurrency volatility itself isn’t the core problem. Poor preparation is.

Many participants enter positions without clearly understanding their risk exposure. They don’t decide in advance how much loss is acceptable or where they’ll exit if conditions change.

When prices inevitably move against them, emotions take control of decision-making. Fear forces them out at the worst possible moment. Greed pulls them back in at precisely the wrong time.

This cycle repeats until their capital gradually disappears.

Information Overload vs. Actual Knowledge

Another silent issue plaguing cryptocurrency participants is information overload. People consume massive amounts of content while acquiring minimal actual knowledge.

They jump from one opinion to another, from one prediction to the next, hoping to find the secret insight that will generate profits.

But markets don’t move based on opinions or predictions. They move based on liquidity flows and market positioning. The loudest voices on social media are rarely the most accurate or knowledgeable.

Real Opportunities Develop Quietly

Most viral online content is designed to attract attention and engagement, not build genuine understanding. If something is appearing everywhere across social media platforms, it typically means the opportunity is already crowded and the easy gains have passed.

Real accumulation by informed participants happens quietly, without excitement or promotional noise drawing attention.

The Importance of Macro Conditions

Macroeconomic conditions play a significantly larger role in cryptocurrency performance than most participants realize. Interest rates, global liquidity conditions, inflation dynamics, and traditional market trends all influence crypto behavior.

Ignoring these broader factors creates unrealistic expectations about how and when cryptocurrency should perform.

Markets move when money moves—when liquidity flows into or out of risk assets. They don’t move simply because hope or enthusiasm increases.

Those who understand this dynamic stop chasing every price movement. They start waiting for favorable conditions to align.

Crypto Isn’t a Lottery

A common destructive mindset is treating cryptocurrency like a lottery or get-rich-quick scheme. People search for shortcuts and fast outcomes, hoping to bypass the learning process entirely.

But cryptocurrency isn’t about speed or quick wins. It’s about survival across multiple market cycles.

Those who survive long enough eventually learn the necessary lessons about risk, psychology, and market structure. Those who rush seeking immediate returns usually disappear from the market permanently.

The Same Story Repeats Across Cycles

If you study past cryptocurrency cycles honestly, you’ll observe the same ending repeating again and again. Different coins gain attention. Different narratives dominate conversations. But the underlying psychology remains identical.

The market structure doesn’t need to change because human behavior doesn’t change. This is why most participants consistently lose money—not because cryptocurrency markets are broken or manipulated, but because behavior patterns are highly predictable.

Crypto Exposes Unprepared Thinking

Cryptocurrency doesn’t specifically punish beginners or favor experienced traders. It exposes unprepared thinking and poor risk management regardless of experience level.

Those who slow down, study market structure, and genuinely respect risk eventually stop reacting emotionally to price movements. They stop chasing noise and attempting to be correct on every trade.

They transition from making predictions to thinking in probabilities. They focus on process and risk management rather than trying to predict specific outcomes.

The Real Difference Between Success and Failure

This represents the fundamental difference between those who survive in cryptocurrency markets and those who don’t.

Not intelligence or technical analysis skills. Not luck or insider information. But consistent behavior and emotional discipline.

The participants who last through multiple cycles aren’t necessarily the smartest or most technically proficient. They’re the ones who learned to control their psychological responses to volatility, who implemented proper risk management, and who stopped treating the market like a casino.

Moving Forward With Realistic Expectations

Understanding that cryptocurrency markets are fundamentally driven by psychology and repeating behavioral patterns doesn’t make them easier to navigate. But it does provide a framework for avoiding the most common and expensive mistakes.

Success in cryptocurrency requires accepting that most opportunities will be missed, most predictions will be wrong, and most of the time the best decision is patience rather than action.

The market will continue presenting the same psychological traps that have worked for decades. The question isn’t whether these patterns will persist—they will. The question is whether you’ll recognize them operating in real-time and respond differently than the majority.

Task Verify Code: Truth